IPO Application Supported by Blocked Amount (ASBA) facility allows investors to apply in an IPO through the net-banking facility offered by the bank.

ASBA stands for "Application Supported by Blocked Amount". It is an IPO application process developed by SEBI that allows the application money to be blocked in the bank account for bidding in an IPO.

Investors cannot use the blocked amount but continue to receive interest on the blocked amount. Once the allocation status is determined and the blocked amount is withdrawn or released.

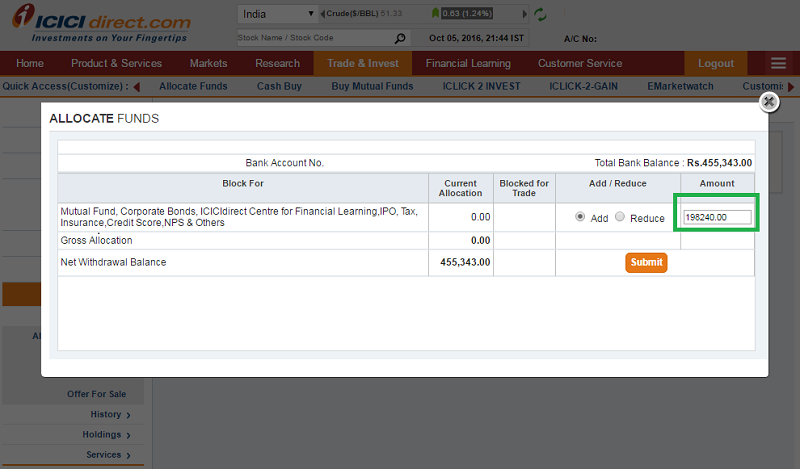

ASBA is a method to block the funds for IPO applications. It permits the bank to block the funds in the customer's bank account until the allotment process is complete.

The funds are withdrawn by the bank when IPO shares are allocated to the customer. The funds are released or unblocked when IPO shares are not allotted or partially allotted to the customers.

The process of blocking the fund is called lien marking in banking terms.

The ASBA route of applying or bidding for the IPO is the simplest, fastest and most convenient way to apply in an IPO.

Banks like SBI, ICICI, HDFC, Kotak, Axis Bank etc. offer ASBA IPO facility.

ASBA IPO application can be applied in two ways:

The online ASBA IPO application is the most convenient way to apply for an IPO. You have to login to the net banking website or mobile app, fill the bidding details on the ASBA IPO Form, validate it and submit the IPO application.

You could also visit your bank's branch to apply in an IPO. While the process remaining the same, you get additional assistance from the branch staff when applying through the branch.

Banks allow ASBA IPO application while the IPO is open for subscription. The online IPO applications are available starting at 10 AM on the issue open date till 5 PM on the issue closing date.

But most banks only provide this facility till 2 PM or 3 PM on the last date. Check Bank wise IPO application cut-off time for more detail.

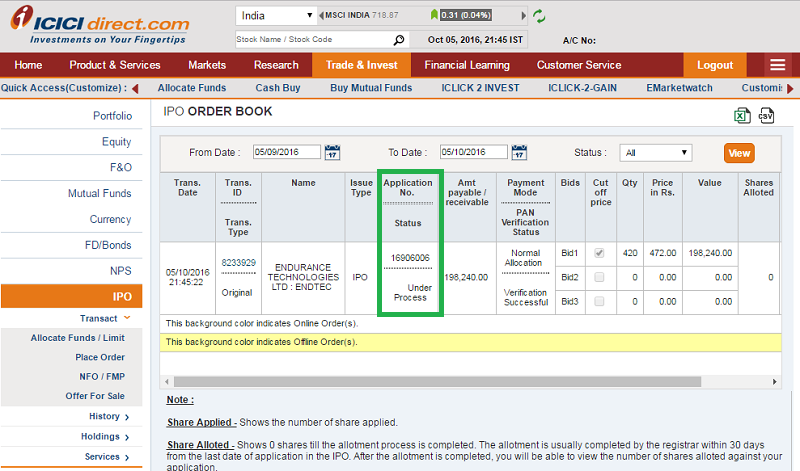

ASBA IPO status is to check the allotment status of IPO application applied using the ASBA facility. The registrar of the IPO is responsible for allocating the shares.

Steps to check ASBA IPO Status

The allocated shares in an IPO are credited to the customer's demat account one day before the listing at stock exchange. Customer can sell these shares on the day of listing by around 10 AM.

IPO Application through the ASBA route offers a convenient way to apply, modify or cancel IPO application. Following is the ASBA IPO Process:

Almost all national level banks offer ASBA IPO applications. This includes popular banks like ICICI Bank, SBI, Kotak Bank, HDFC Bank, Axis Bank ect.

Some banks like SBI and Axis Bank offer 3rd Party IPO Applications. These banks permit up to 5 IPO applications on different names using one bank account.

Note that only 1 IPO application is permitted in an IPO for one person (unique PAN Number).

There are types of banks for applying in IPO using ASBA.

Note: As per regulation;

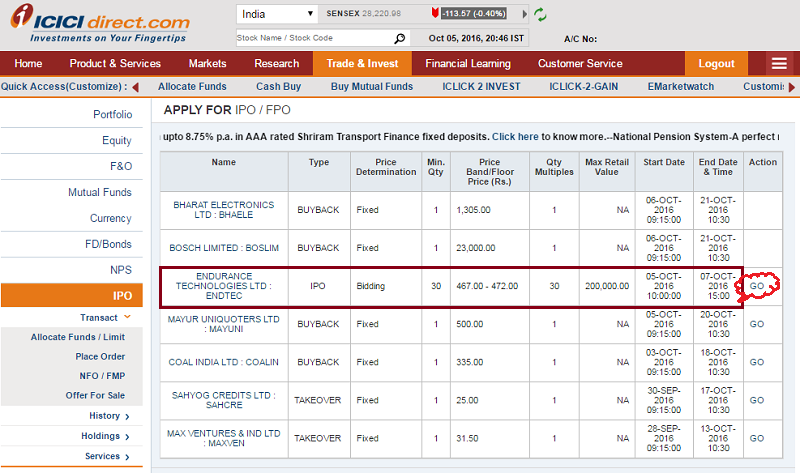

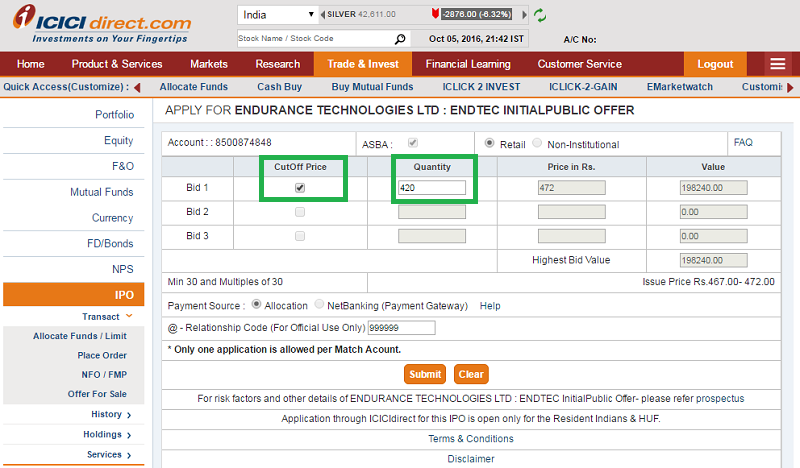

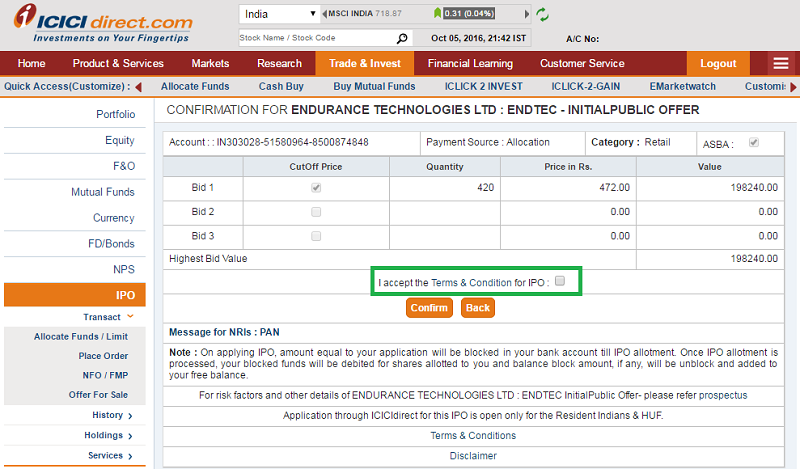

Following are the steps to apply in an IPO using ICICI Bank ASBA IPO Application.

ASBA stands for 'Application Supported by Blocked Amount'. ASBA is an application mechanism which gives an authorization to Self Certified Syndicate Bank (SCSB) to block the application money in the bank account for subscribing to a public issue. If an investor is applying through ASBA, his/her application money got debited from the bank account after the basis of allotment is finalized and the application is selected for allotment or the issue is withdrawn/failed. It is mandatory for all public issues opening on or after January 01, 2016 to apply through ASBA only. The investor can download e-form from NSE website for any issue. Also they can download the form from BRLM's (Book running lead manager) website.